Back to articles

Press Release

We're delighted to share our 2021 ESG Report which details the strides we've made towards our goal of supporting a more sustainable future by making a meaningful difference with our business practices globally.

The global clean energy industry has seen enormous growth over the past year as record amounts of public and private capital have poured into renewable energy development. Investment was driven at first by a recognition of the worsening climate crisis and vital need to take action to meet climate goals, but the war in Ukraine has super charged efforts to rapidly build out renewable supply as a way to not only decarbonize, but also improve energy security by lessening dependence on Russian energy resources.

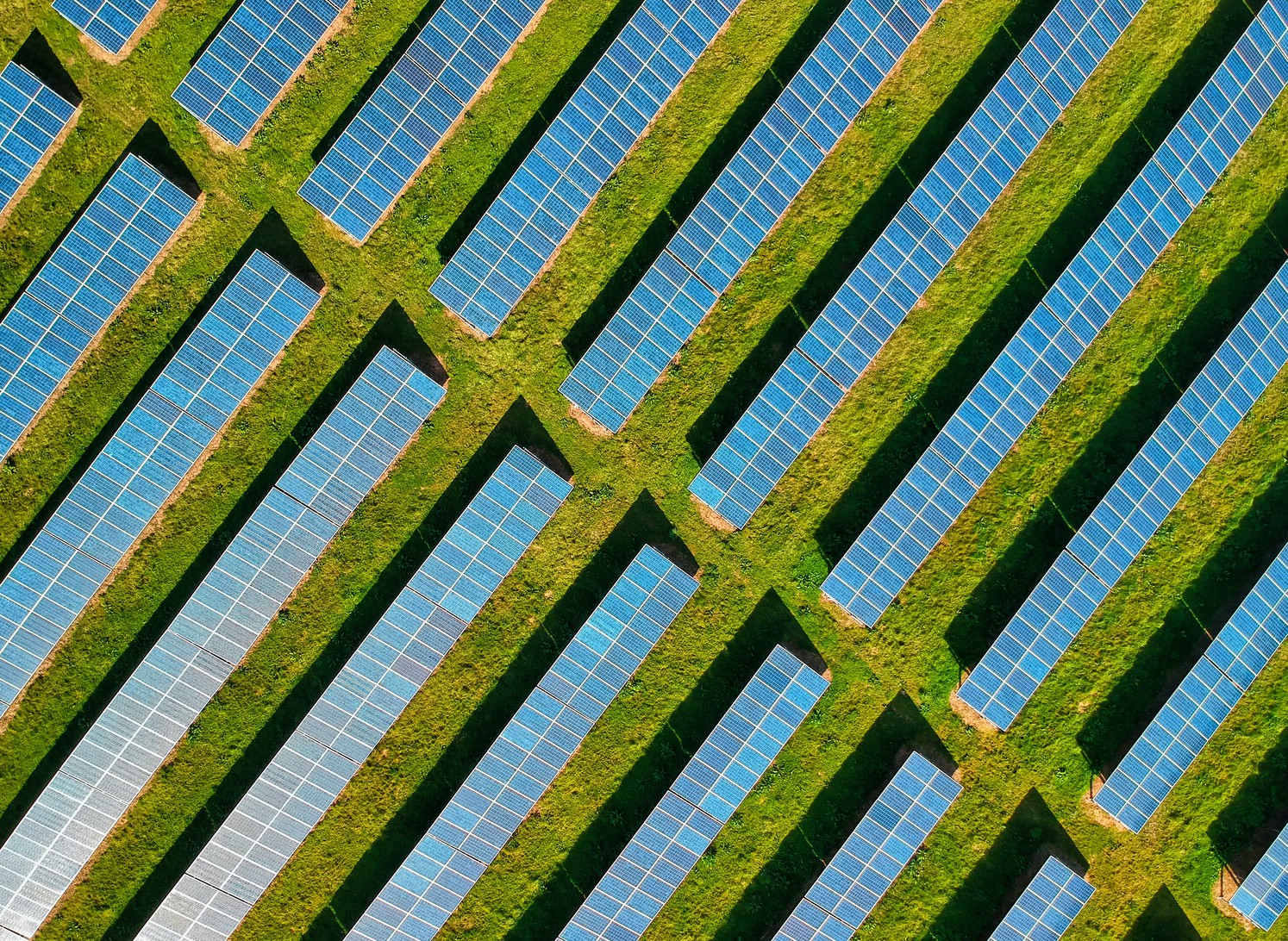

Trailstone has supported industry growth first hand by helping asset owners manage risk and optimize production for their solar and wind assets to maximize energy trading revenues. And we’ve seen a lot of growth ourselves. Below are a few highlights from the first six months of 2022.

We entered 5 new markets

Trailstone now offers risk management, asset optimization and energy trading services in 20 global markets. During the first half of 2022 we began offering our services in the Southwest Power Pool (SPP), Midcontinent Independent System Operator (MISO), and California Independent System Operator (CAISO) markets in the U.S. In Europe, we added Hungary and France to our growing list of European markets.

We announced a new office in Ireland

We recently announced that we will be opening a new office in Sligo, Ireland, that will bring up to 20 new jobs to the North West region over the next 3 years. We didn’t just choose Sligo for its beautiful coastline. With the booming Irish wind industry and access to top tech talent close by at the Atlantic Technological University Sligo, this new office will help us better support renewable asset owners in the Emerald Isle in addition to driving tech innovations that will benefit our customers across all of our global markets.

We reached over 1 GW of renewable assets managed in the United States

The U.S. is primed for a surge of renewable energy growth over the coming decade with a national goal to reach 100 percent carbon pollution free electricity by 2035. As more intermittent resources come online, U.S. markets are becoming increasingly complex and volatile. To mitigate this dynamic environment for asset managers, Trailstone now manages more than 1 GW of renewable assets in the U.S. with the recent addition of two solar farms totalling ~440 MW in Texas. We’re proud to help more U.S. asset owners manage risk and navigate market complexity by pairing our advanced technology with expert teams. We’ve watched similar trends play out in European markets throughout the years, and pair this experience with our expertise in the distinct intricacies of U.S. energy markets to continue expanding and evolving our solutions for each unique landscape.

We grew our staff by 21%

In the first half of 2022 alone, we have increased our staff by more than 21% with 13 new hires in Q1 and 30 in Q2. We have hired across the organization, with the majority of new hires being on our tech teams, which are working to continuously improve the AI and Machine Learning models at the core of our asset management technology. Our team continues to grow, and we are working to fill several open positions to support increasing demand for our services.

We joined the 24/7 Carbon-Free Energy compact

We’re proud to join policymakers, large energy users and other clean energy companies in the 24/7 Carbon-Free Energy Compact, a global initiative to accelerate the transition to a carbon-free electricity sector created in partnership with Sustainable Energy for All and UN Energy. Signatories commit to developing and scaling energy policies, technologies, procurement practices, and solutions to transform the broader energy ecosystem and enable rapid and cost-effective achievement of carbon-free energy for all. The compact directly aligns with our mission of making sustainable energy sustainable by addressing the intermittency and risks associated with renewable energy to improve returns and spur further development of renewables.